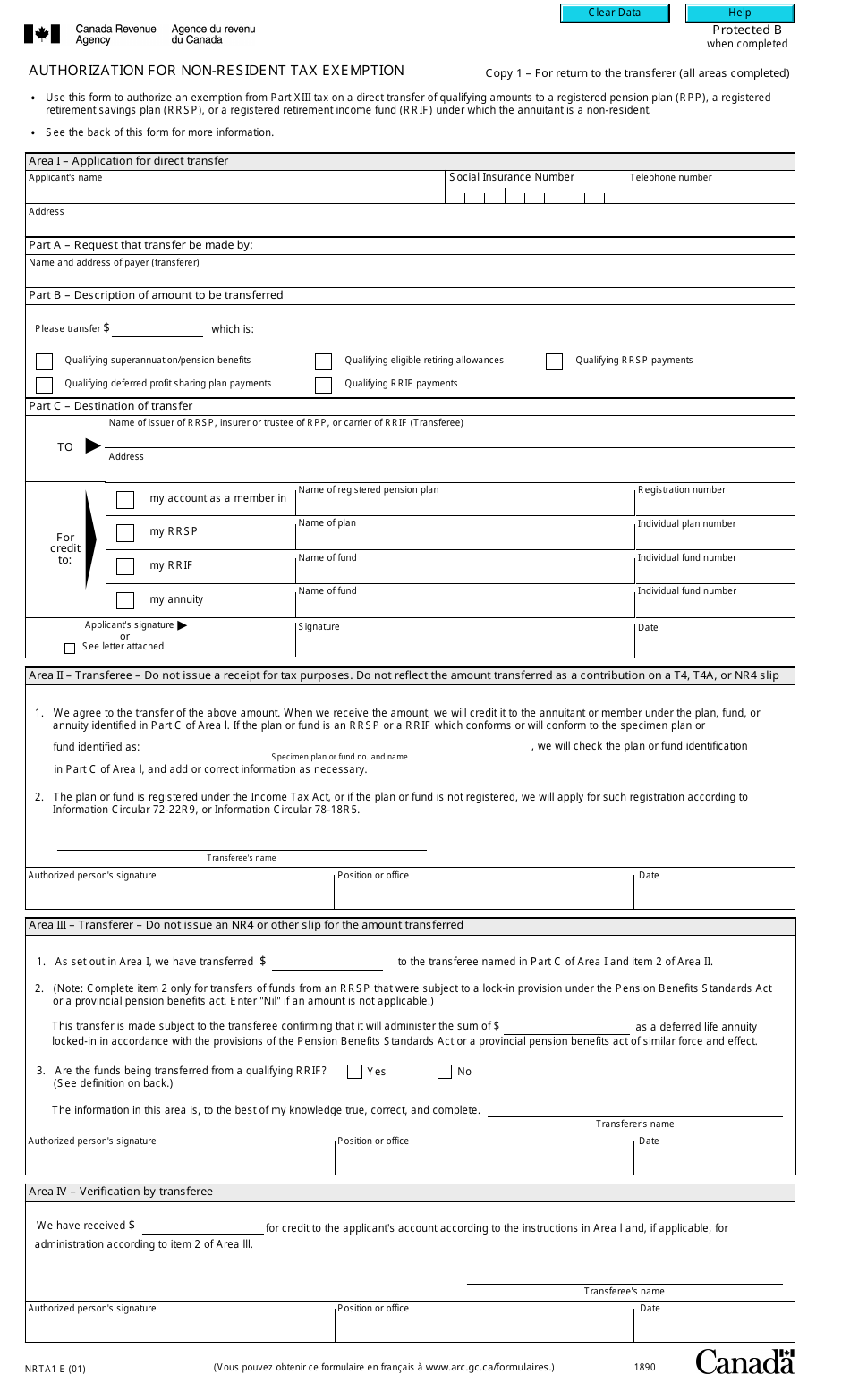

Form NRTA1 Download Fillable PDF or Fill Online Authorization for Non-resident Tax Exemption Canada | Templateroller

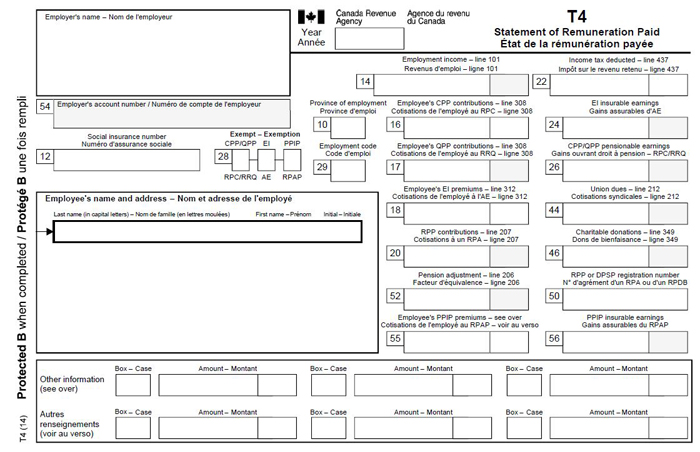

Service Canada on Twitter: "Do you receive EI, CPP or OAS? To receive this year's slips online, make the change in My Service Canada Account under “Tax slip mailing options” before January

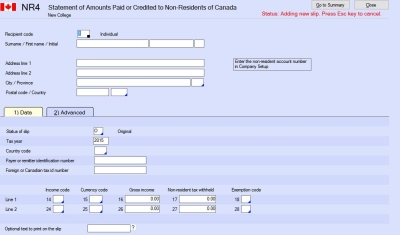

Veterans Affairs Canada - REMINDER - If you received Financial Benefits from VAC in 2020, you should have received your income tax slips (T4A, NR4, RL1, RL2). If you are registered for